An alternative to credit cards? Afterpay off to strong start in US market

Mar 15, 2019, 11:27 AM | Updated: 2:14 pm

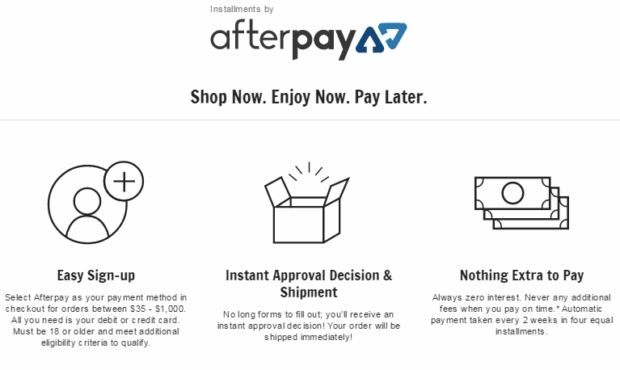

Screenshot of Afterpay's explanation of services on the Urban Outfitters website. March 5 2019

You may have noticed a new payment option while shopping online.

Afterpay, an Australian company that launched in the U.S. in May 2018, lets customers pay for an item in four equal installments without any interest or annual fees. And last week, they hit their millionth U.S. customer.

Dave Ross spoke with James Eyers, a senior reporter on banking and financial technology at the Australian Financial Review in Sydney.

Eyers says Afterpay was initially attractive to young, female shoppers as a budgeting tool for expensive shoes or a nice dress that might otherwise be out of reach. The company has since expanded into menswear, beauty, and children’s clothing.

, including companies like Anthropologie, DSW, Everlane, and online retail powerhouse Revolve have been willing to sign on to the service.

The company has a team in Silicon Valley, and it has plucked engineering talent out of Uber and a few other U.S. tech companies in hopes to make a strong push into the U.S. retail market, Eyers said. However, assembling those teams is costly, and the company is currently running at a small operating loss. Investors, however, remain confident.

“[Retailers] have had customers coming back through their feedback channels in their stores saying – why aren’t you offering Afterpay? We want to pay with Afterpay,” Eyers said.

When a customer uses Afterpay to make a purchase, the retailer gives up a cut of that sale. This isn’t a huge leap in terms of concept, because retailers already pay interchange fees to credit card companies like Visa and MasterCard. But Afterpay’s fees are significantly higher, at 4-6 percent of the total cost of the item.

The company is banking on a trend they believe they’ve identified: the millennial market’s aversion to credit. Eighty-five to ninety percent of Afterpay accounts in Australia are linked to a debit card.

“It appears that the millennials don’t like credit cards as much as elder generations do,” Eyers said. “We’ve looked at the credit card data and it’s on the wane in Australia for younger cohorts, and debit cards are on the way up.”

Eyers said he thinks there’s a long way to go before Afterpay presents a serious challenge to the likes of Visa, MasterCard or PayPal. But he said he is sure they are watching closely.

Short sellers of Afterpay’s stock think the company has predatory lending practices and targets people who won’t be able to repay. The Australian Securities and Investments Commission last month looked into “Buy Now, Pay Later” services like Afterpay and one of its main competitors, Affirm.

“There was a light touch regulatory approach applied,” Eyers said. “Because Afterpay doesn’t charge any interest, it’s not considered a financial product under Australian law, so they don’t have to adhere to the consumer protection, responsible lending laws that make them have to check customers very carefully.”

And it’s true that the on-boarding process takes a matter of minutes. Click on the Afterpay logo next to the item you want to purchase, and you can quickly set up your account, link a payment card, and find out almost instantly if you’ve been approved to use the service.

“There was a sense that some vulnerable customers, those that might not necessarily be able to receive credit from a bank or be able to get a credit card, were able to quite quickly and easily on-board to the service and spend beyond their means,” Eyers said. “There are plenty of skeptical analysts in the Australian market.”

But the speed of the on-boarding process is something the company seems reluctant to relinquish. Instead, they have tried to self-regulate in other ways.

Afterpay charges a $7-10 late fee every week that you fall behind on a payment. Recently, the company decided to cap all late fees at 25 percent of the total cost of the item. Afterpay also won’t let customers continue to make purchases through their platform if they have missed payments in the past.

“Unlike a credit card where you can build up quite a large debt and revolve that debt and continue to spend … Afterpay will only let you use the service while you’re up to date with all your payments,” Eyers said. “So they say that limits the potential for people to spiral into some kind of debt trap.”

All Afterpay purchases must be between $35-1,000.

What kind of regulation, if any, do you think Afterpay may face stateside?

To listen to a full version of this interview, check out the